I think everyone remembers their first car and the sense of independence and freedom that came with it. Mine was a used 1966 Oldsmobile Cutlass convertible with a bunch of miles on it. A V-8 under the hood with 360 lb-ft of torque. I loved that car. It served me well and managed to survive my college days, which was no easy feat. Fast forward some 40 years, and I am still behind the wheel of an internal combustion engine (ICE) vehicle, albeit one that’s a heck of a lot more fuel efficient. In those four decades, we’ve developed and implemented direct fuel injection, airbag systems, Bluetooth, anti-lock brakes, and countless other technologies into our everyday driving lives.

Is the time now?

Today, increasingly, we find ourselves next to a Tesla stopped at a light, pondering the possibility of this next stage of automotive development. If you are like me, you think, “Yeah, probably. Someday. But not right now.” But for millions of people around the globe, that someday is now. According to the International Energy Agency (IEA), about 3 million new electric cars were registered in 2020. For the first time, Europe beat out China with 1.4 million new registrations. China had 1.2 million, and the United States had 295,000. China and Europe each had more than four times that of the United States – a noteworthy fact.

The IEA further states that “there were 10 million electric cars on the world’s roads at the end of 2020, following a decade of rapid growth, and a 43% increase over 2019. Electric car registrations increased by 41% in 2020, despite the pandemic-related worldwide downturn in car sales in which global car sales dropped 16%. Electric bus and truck registrations also expanded in major markets, reaching global stocks of 600,000 and 3,000, respectively.”

Automobile production, particularly the internal combustion engine and corresponding drivetrain, has been a major contributor to American manufacturing development since the turn of the century and has traditionally held the lion’s share of global machine tool consumption. A complete technology transformation within the auto industry is a bit of a scary proposition for everyone in the manufacturing technology space, yet it also represents tremendous opportunities.

The ripple effect of EV adoption

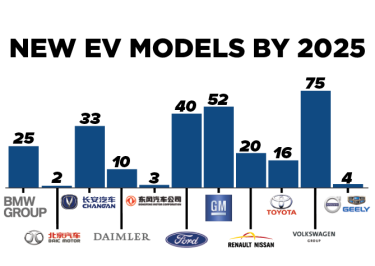

Over the past year, AMT’s weekly “International News From the Field” column has documented and highlighted numerous specific technology sales opportunities, mostly in China, India, and Europe, specific to the EV industry. They represent billions and billions of dollars. Many of them are on-the-ground, country-specific examples of the graphic presented in IEA’s “Global EV Outlook 2021” illustrating the commitment that 18 of the 20 largest automotive OEMs have made to increasing their EV offerings and sales (see figure).

The opportunities certainly go beyond the vehicle OEMs and their new lines. Critical components like e-motors and batteries are seeing mega investments both in R&D and production. Tier-one suppliers like Bosch, ZF, Schaeffler, and BorgWarner, to name a few, are knee-deep in e-mobility developments.

Then there is the issue of keeping the world’s EV fleet powered up. Take just the United States, for example. McKinsey & Co. projects that commercial and passenger fleets in the United States could include as many as 8 million EVs by 2030. They state that this will require “some $11 billion of capital investment by 2030 to deploy the 13 million chargers needed for all of the country’s EVs. Fleet EVs alone would consume up to 230 terawatt-hours of power per year, which would be approximately 6 percent of current US power generation.” OK. You get the idea. The same will be true everywhere.

It is certainly clear that the EV industry and supporting infrastructure should be part of any manufacturing technology supplier’s long-term strategy. AMT can help you align your products and services to specific global opportunities identified by our international team. For more information and to stay up to date on global shifts, visit AMTonline.org to subscribe to the AMT bi-weekly newsletter and to read our weekly “International News From the Field” column.